7.5 Exercises - ARIMA

7.5.1 IBM stock, problem 12 p 405

Qa

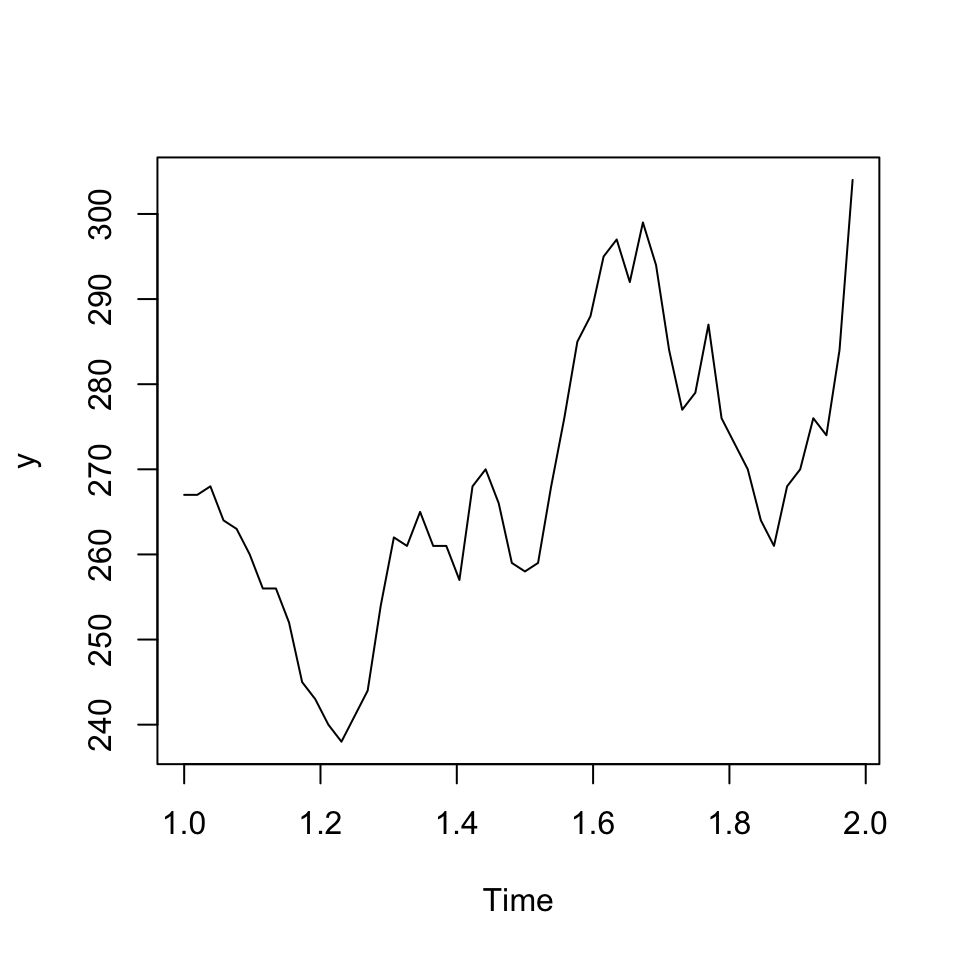

The data in Table P-12 are weekly prices for IBM stock.

#Loading

y <- read_excel("Data/Week47/IBMstock.xls") %>% ts(frequency = 52)

#Plotting

ts.plot(y)

Figure 7.1: IBM stock prices

It is dififult to say if there is a trend, but there appear to be seasons. This can be futher expected with the correlogram

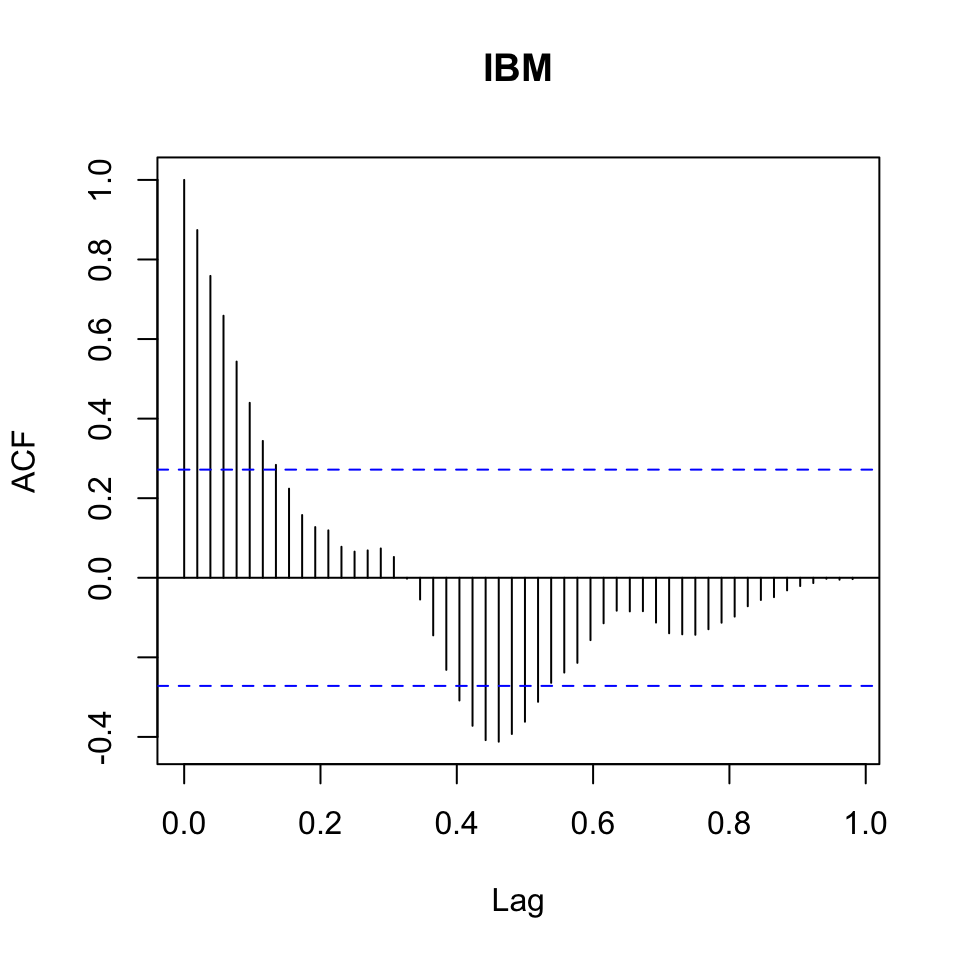

acf(x = y

,lag.max = 52) #We take for a whole year

Figure 7.2: Correlogram (acf) IBM Stock prices

The correlogram suggests that there is seasonality in the data. We only have data for one year, hence 52 periods. It would be interesting to see if the patterns express it self over years.

We could also express the pacf.

The partial correlation coefficient is estimated by fitting autoregressive models of successively higher orders up to lag.max.

pacf(x = y

,lag.max = 52) #We take for a whole year

Figure 7.3: Correlogram (pacf) IBM Stock prices

What approaches does this suggest?

It suggests, that we should use an AR model, as the acf is tending towards 0 while the pacf quickly drops to 0.

Qb

Looking at the ts plot, the data does not appear to be stationary. Perhaps there is a small indication of a trend in the data, hence not constant variance around a fixed point.

It therefore suggests that we move into ARIMA, where we apply d order differencing.

Qc

We apply AR and d, where we first try with first order, to assess if it is sufficient.

p <- 0 #AR order

d <- 1 #Differencing order

q <- 0 #MA order

order <- c(p,d,q)

ARIMAmod <- arima(x = y #The time-series

,order = order

)

#Assessing in-samp accuracy

accuracy(object = fitted(ARIMAmod)

,x = y)## ME RMSE MAE MPE MAPE ACF1 Theil's U

## Test set 0.7166731 6.090774 4.793596 0.2270925 1.759575 0.2971583 1We see an mean percentage error of 1,64%. That is quite low. But also expected as it is in sample.

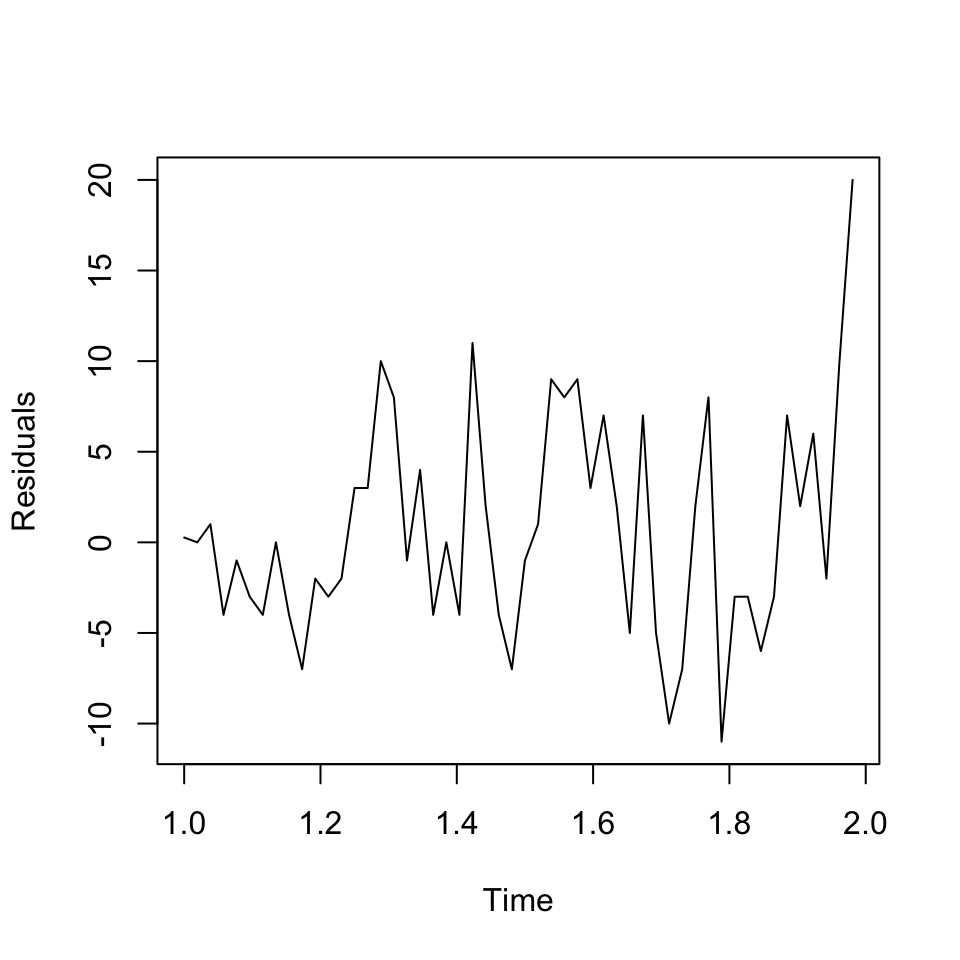

plot(ARIMAmod$residuals,ylab = "Residuals")

Figure 7.4: Residuals plot IBM stock ARIMA 1,1,0

The changes appear to be randomly distributed around 0.

Qd

Perform diagnostic checks to determine the adequacy of your fitted model

Residuals to be random

We see from the residuals plot above. It was difficult to get rid of heteroskedasticity

Note, it was tested with only differencing, and appear to have a more constant variance with this

but we still see something indicating that the variance is not entirely constant

Constant variance

This can also be checked using a Ljung-Box test, where the null hypothesis is that there is no relationship between the observations.

Box.test(ARIMAmod$residuals

,fitdf = p+q) #Because it is applied to and ARIMA model##

## Box-Pierce test

##

## data: ARIMAmod$residuals

## X-squared = 4.5918, df = 1, p-value = 0.03213We see that the p-value is below the p-value (5%), hence the model is under misspecification. Although we are close to the threshold, let us assume that it is sufficient.

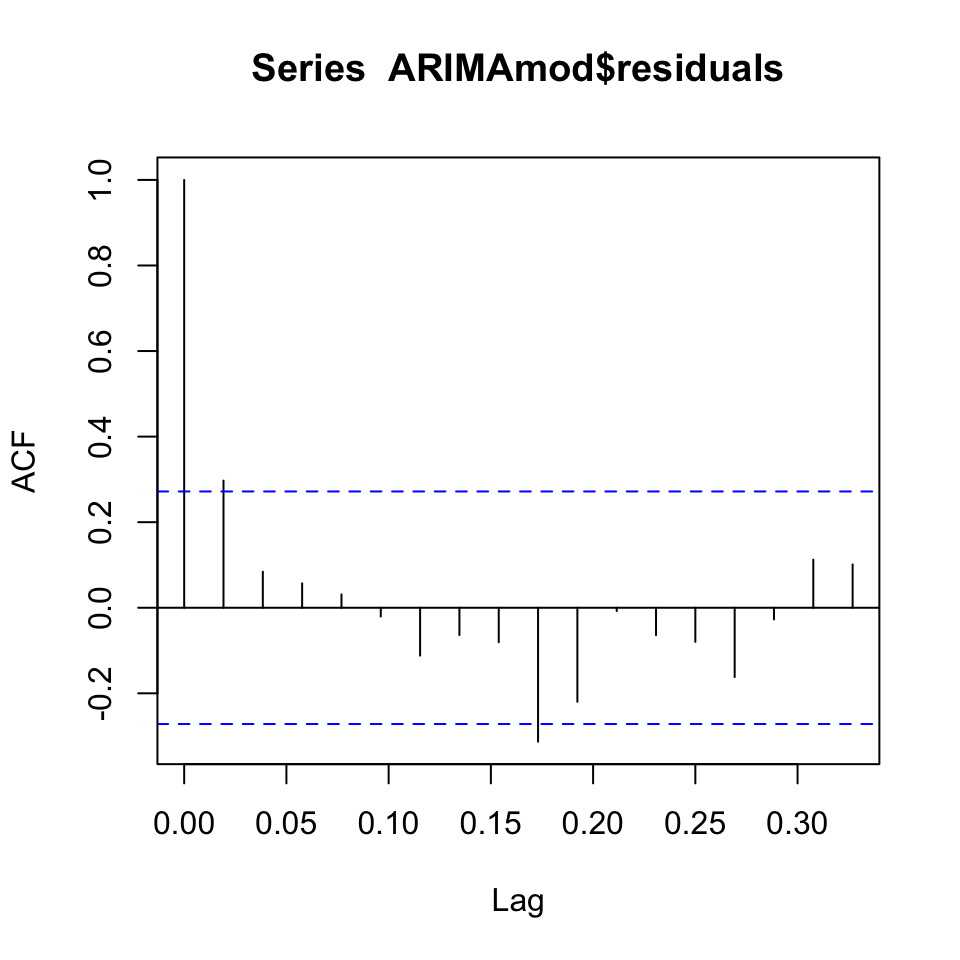

Autocorrelation in residuals

We see that the errors appear not to show autocorrelation. Although there is one period, that does appear to have a spike + the first lagged period, but it is close to the recommended threshold.

acf(ARIMAmod$residuals)

Then one could test other models and see if they perform better. I have been playing around with the orders, but it does not appear to help with the residuals.

Qd

Make forecast for the stock price in week 1.

{

forecast(object = ARIMAmod,h = 1) %>% print()

y[nrow(y),] %>% print()

}## Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

## 2 304 296.1184 311.8816 291.9461 316.0539

## IBM

## 304We see that the forecast is 311,73 where the naive forecast (the most recent period) would just say 304.

Although one must be very precautions, as it was found that the model is under misspecification

rm(list = ls())7.5.2 Demand data, problem 7 p 403

Loading the data

df <- read_excel("Data/Week47/Demand.xls")

y <- ts(data = df,frequency = 52)Qa

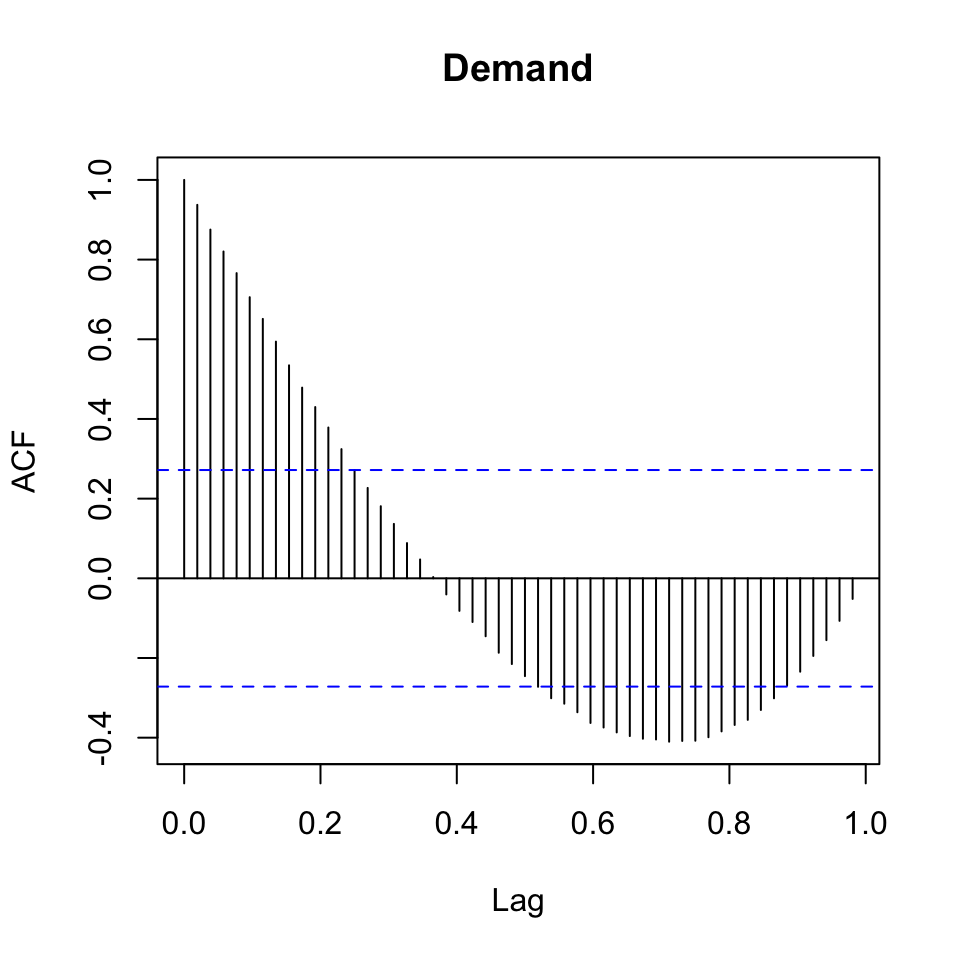

Plotting acf

acf(y,lag.max = 52)

Figure 7.5: acf Demand

We see that there is clearly a trend and it appears as if we have seasons, although looking at it does not appear as if we have seasons.

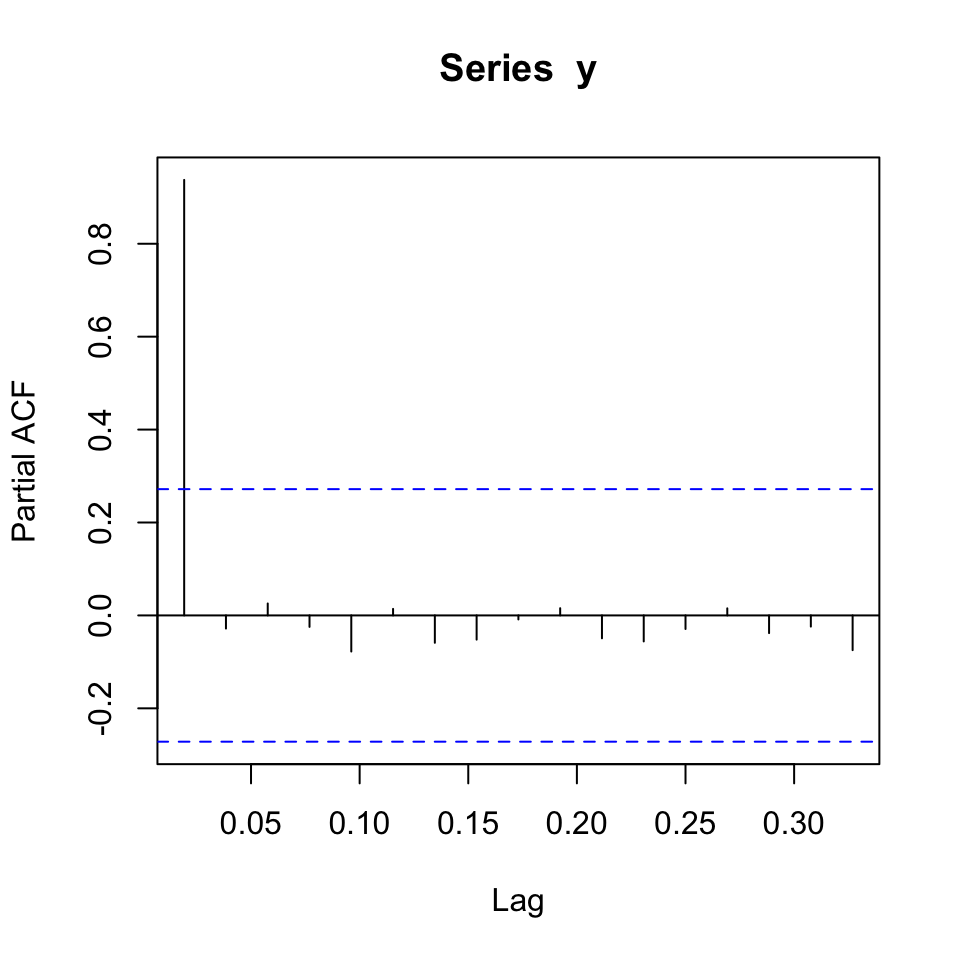

We can support this with a pacf

pacf(y)

We are able to use an autoregressive approach as acf tends towards 0 and pacf quickly drops to 0.

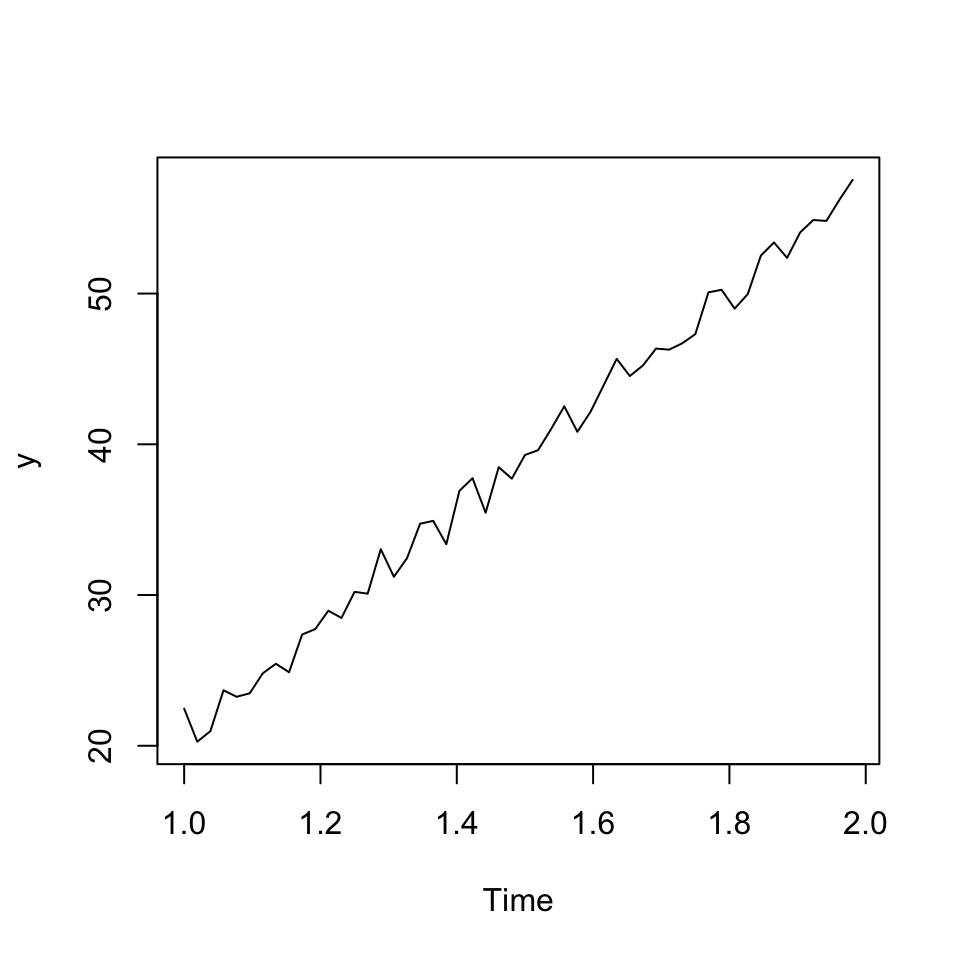

Lastly we can check for stationarity.

ts.plot(y)

Figure 7.6: Demand time-series

We observe non stationary data, hence we should apply differencing as well.

Qb

Manually doing ARIMA

p = 1

d = 1

q = 0

order <- c(p,d,q)

ARIMAmod <- arima(x = y

,order = order)

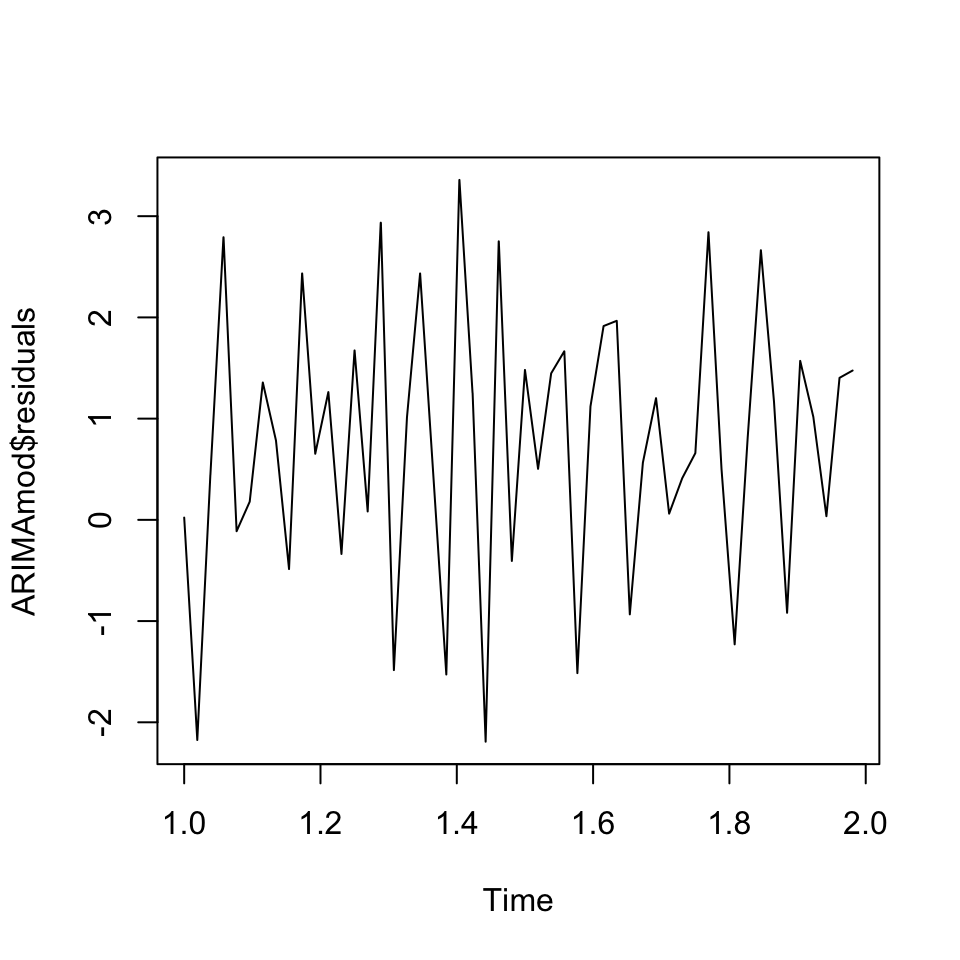

plot(ARIMAmod$residuals)

Figure 7.7: Residuals ARIMA

Auto ARIMA

We are also able to apply auto.arima() to find the most optimal combination based on the sample data.

# Making the model

ts.arima <- auto.arima(y = y)

summary(ts.arima)## Series: y

## ARIMA(2,1,1) with drift

##

## Coefficients:

## ar1 ar2 ma1 drift

## -0.3531 -0.4859 -0.8662 0.7106

## s.e. 0.1461 0.1399 0.1214 0.0101

##

## sigma^2 estimated as 0.7302: log likelihood=-63.77

## AIC=137.54 AICc=138.87 BIC=147.2

##

## Training set error measures:

## ME RMSE MAE MPE MAPE MASE

## Training set -0.04310129 0.8124002 0.6510066 -0.2215986 1.820533 NaN

## ACF1

## Training set 0.005108341We see that the this suggest a full ARIMA model with 2 order AR, 1 order differencing and 1 order MA.

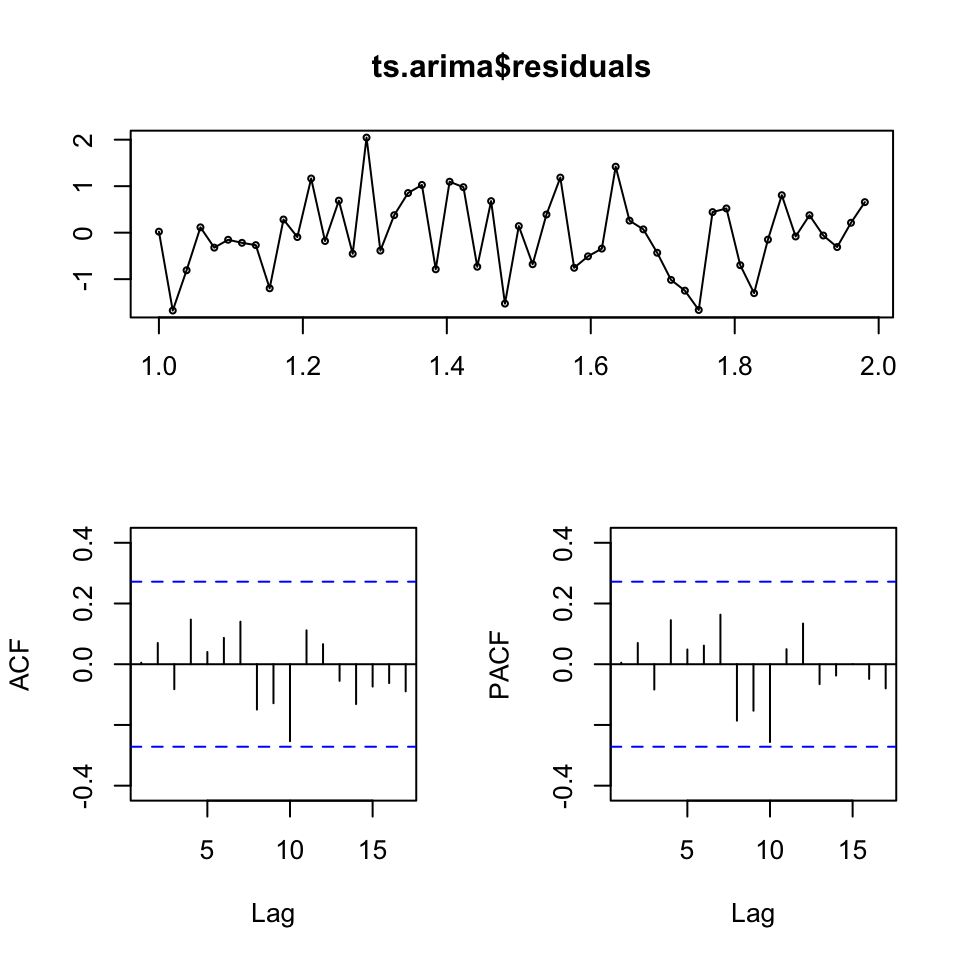

Now we can display the residuals to check for independence within the error terms.

tsdisplay(ts.arima$residuals)

Figure 7.8: Residuals time-series demand

It appears as if with have independence in the residuals and also none significant spikes in the correlograms.

We can make a statistical check for this as well, using the Box-Pierce test

Box.test(ts.arima$residuals)##

## Box-Pierce test

##

## data: ts.arima$residuals

## X-squared = 0.0013569, df = 1, p-value = 0.9706We see that we cannot reject the null hypothesis, hence it is fair to assume that the observations are independent of each other.

Qc

equation for forecast:

Cant find the constant, but one can call the coefficients with the following:

ts.arima[["coef"]]## ar1 ar2 ma1 drift

## -0.3530653 -0.4859323 -0.8662332 0.7105675Qd

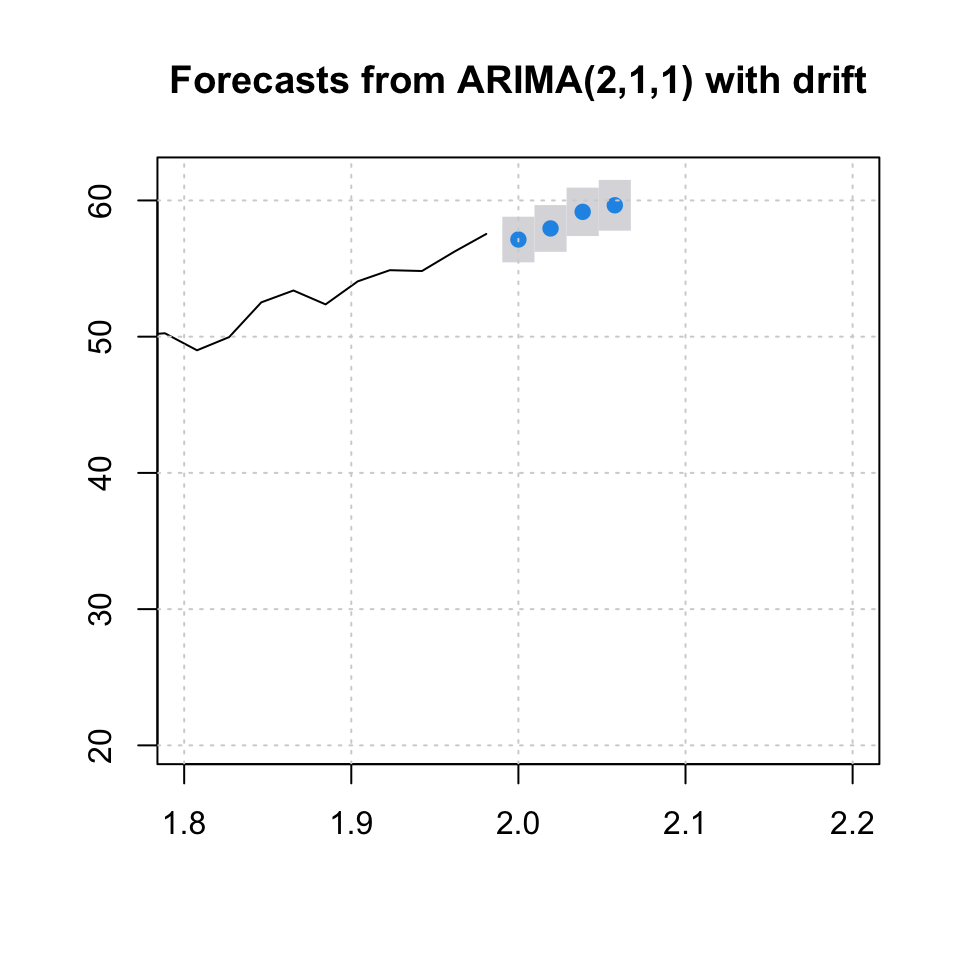

Forecasting demand for the coming four periods. That can be done using forecast() where h = 4

arima.fh4 <- forecast(ts.arima

,h = 4 #Forecast horizon

,level = 0.95 #Confidence interval

)

knitr::kable(arima.fh4,caption = "Forecast with confidence intervals")| Point Forecast | Lo 95 | Hi 95 | |

|---|---|---|---|

| 2.000000 | 57.13051 | 55.45568 | 58.80534 |

| 2.019231 | 57.94525 | 56.23062 | 59.65988 |

| 2.038462 | 59.16331 | 57.38801 | 60.93861 |

| 2.057692 | 59.64408 | 57.78105 | 61.50711 |

plot(arima.fh4,xlim = c(1.8,2.2))

grid(col = "lightgrey")

rm(list = ls())7.5.3 Closing stock quotations, problem 13 p 409

df <- read_excel("Data/Week47/ClosingStockQuatations.xls")

y <- ts(df,frequency = 365)

y.train <- y[1:145]

y.test <- y[146:150]

ts.arima <- auto.arima(y.train)

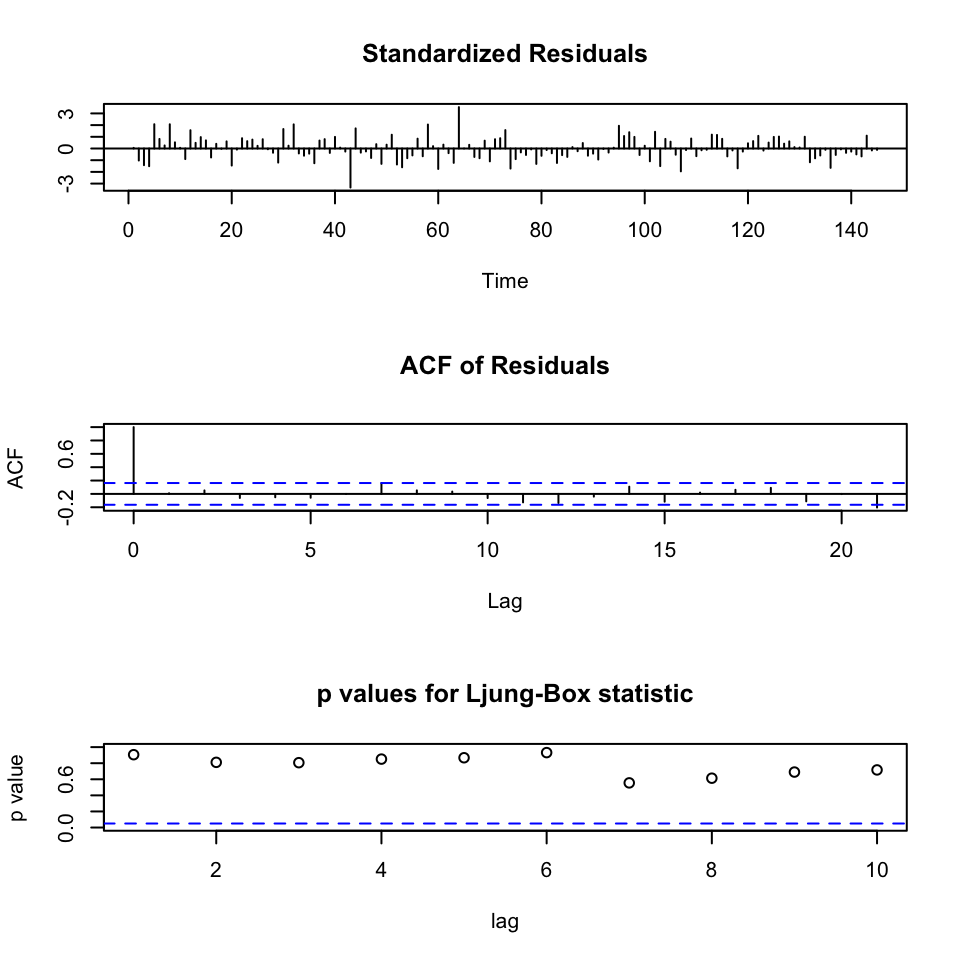

tsdiag(ts.arima)

Figure 7.9: Diagnostics for ARIMA

We see that the residuals appear to be randomly distributed around a fixed point. Also there does not appear to be residuals that spikes, indicating autocorrelation in the residuals. Assessing the Ljung-Box statistic, we see that there are no values that go beyond the critical level of 5%. Hence it is fair to assume that the residuals are independent of each other.

arima.fh5 <- forecast(ts.arima,h = 5,level = 0.95)

knitr::kable(arima.fh5,caption = "Forecast with confidence level")| Point Forecast | Lo 95 | Hi 95 | |

|---|---|---|---|

| 146 | 133.8119 | 128.8361 | 138.7878 |

| 147 | 133.8119 | 128.6346 | 138.9893 |

| 148 | 133.8119 | 128.4407 | 139.1832 |

| 149 | 133.8119 | 128.2535 | 139.3704 |

| 150 | 133.8119 | 128.0724 | 139.5515 |

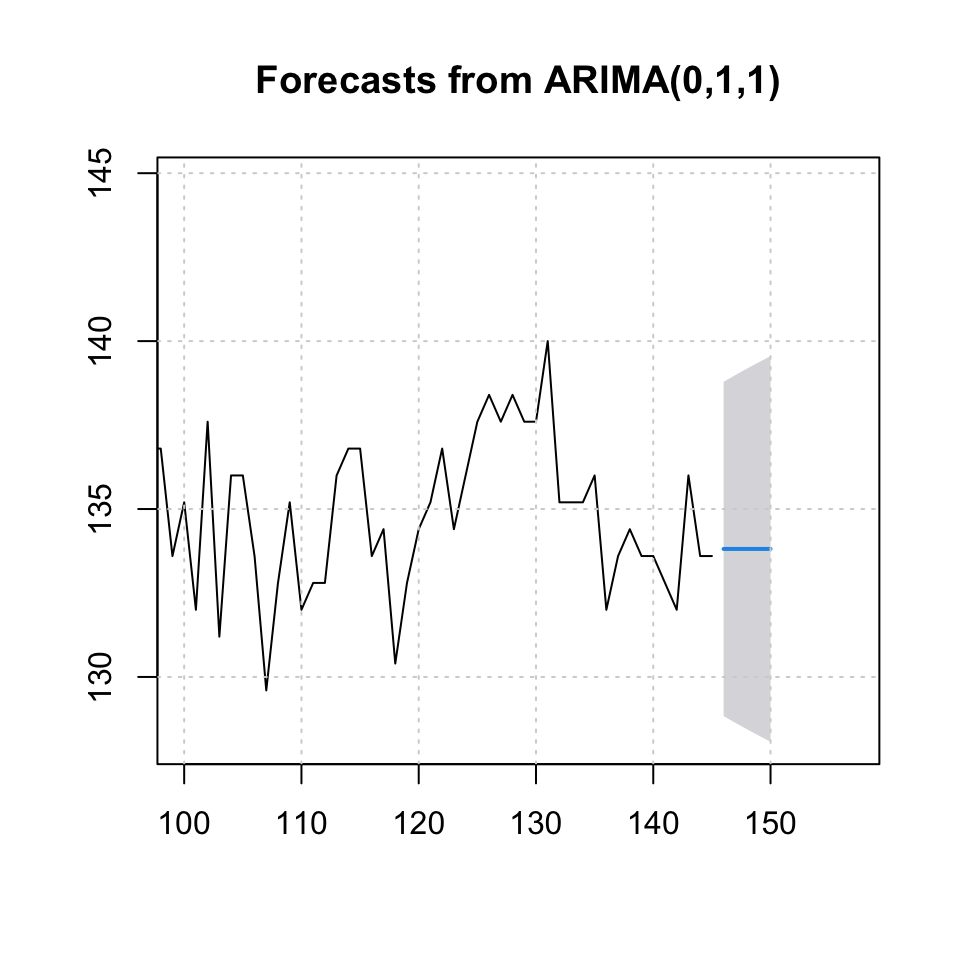

plot(arima.fh5,xlim = c(100,157))

grid(col = "lightgrey")

Figure 7.10: Forecast Stock Quotations

accuracy(arima.fh5$mean,x = y.test)## ME RMSE MAE MPE MAPE

## Test set 2.508054 3.000656 2.508054 1.82561 1.82561We see that the accuracy is 2.5 MAE where the MAPE is 1.8

rm(list = ls())7.5.4 HW: Case 1 page 413-414 (q1-3)

df <- read_excel("Data/Week47/Case1p413-414.xls")

y <- df$`Sales(old data)`

y <- na.exclude(y)

y <- ts(y,frequency = 54,start = c(1981,1))1. What is the appropriate Box-Jenkins model to use on the original data?

First we will assess this manually.

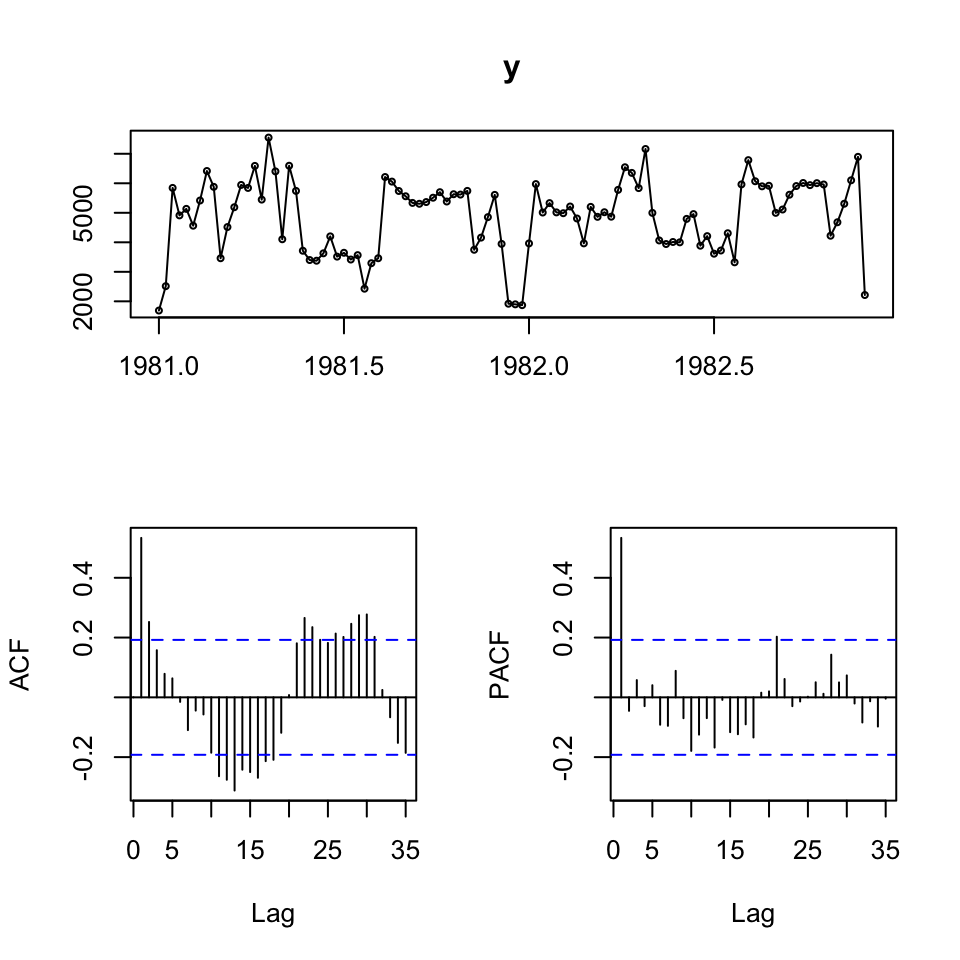

tsdisplay(y)

We see that the data look somewhat stationary, but lets test that:

adf.test(y)##

## Augmented Dickey-Fuller Test

##

## data: y

## Dickey-Fuller = -3.3134, Lag order = 4, p-value = 0.0727

## alternative hypothesis: stationaryWe are not able to reject the null, hence it is not stationary.

dy <- diff(y)

adf.test(dy)##

## Augmented Dickey-Fuller Test

##

## data: dy

## Dickey-Fuller = -5.6042, Lag order = 4, p-value = 0.01

## alternative hypothesis: stationaryWe see that the data is normally distributed now.

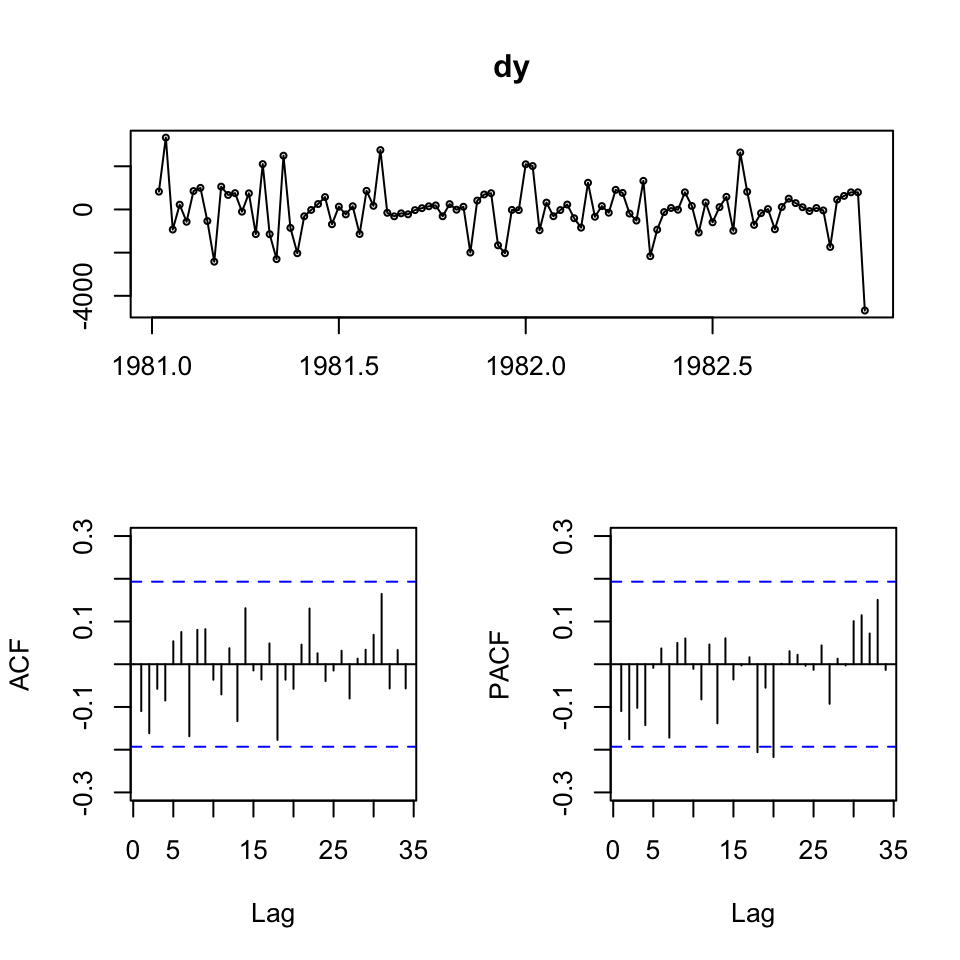

tsdisplay(dy)

Looking at the acf and pacf, the appear to initially tend towards 0, hence it could be applicable with an ARMA(1,1) model. Or perhaps shifting a bit from negative to positive, also indicating ARMA(1,1).

As the data is difference, we must remember to add the order of integration, hence we are operating with an ARIMA model of order (1,1,1).

Regarding seasonality, it is not clear whether there is seasonality. To assess this, one could make a decomposition of the time series:

Summary:

- We expect I = 1 or 0, as it is close to being stationary

- We expect AR = 1

- We expect MA = 1

- We do not expect corrections for seasonality

- We don’t see an overall trend and do not expect a drift

Let us apply auto.arima to optimize against AIC, hence low risk, thus prediction.

m.arima <- auto.arima(y = y,ic = "aic")

summary(m.arima)## Series: y

## ARIMA(1,0,0) with non-zero mean

##

## Coefficients:

## ar1 mean

## 0.5931 4802.4356

## s.e. 0.0847 243.9703

##

## sigma^2 estimated as 1060812: log likelihood=-868.25

## AIC=1742.51 AICc=1742.75 BIC=1750.44

##

## Training set error measures:

## ME RMSE MAE MPE MAPE MASE ACF1

## Training set 23.78403 1020.006 750.8478 -5.885515 18.94088 0.7344547 0.02222022According to the automation process. We see that the model only suggest an AR(1) model. We saw that the ADF test was close to the 5% level and that we could reject on a 10% level, hence it is not strange, that the model is specified with d = 0.

2. What are your forecasts for the first four weeks of January 1983?

Is the forecast reliable?

This will be checked with

- Residuals to be random, no autocorelation left in them. Can be checked with Jarque-Bera test. Where H0: Normality

jarque.bera.test(m.arima$residuals) #Jarque-Bera test the null of normality##

## Jarque Bera Test

##

## data: m.arima$residuals

## X-squared = 14.854, df = 2, p-value = 0.0005949We are able to reject the null hypothesis, hence the residuals are not normally distributed, hence it appears as if we excluded data.

We could visually inspect the residuals also:

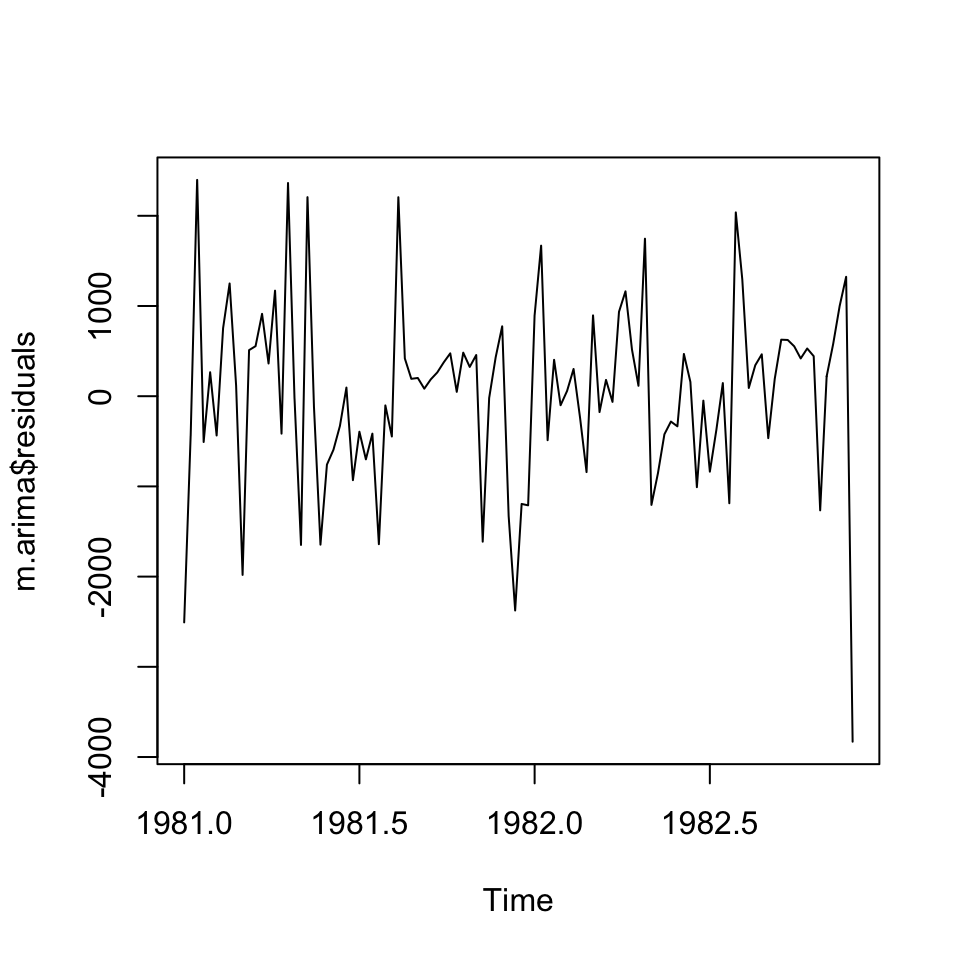

plot(m.arima$residuals)

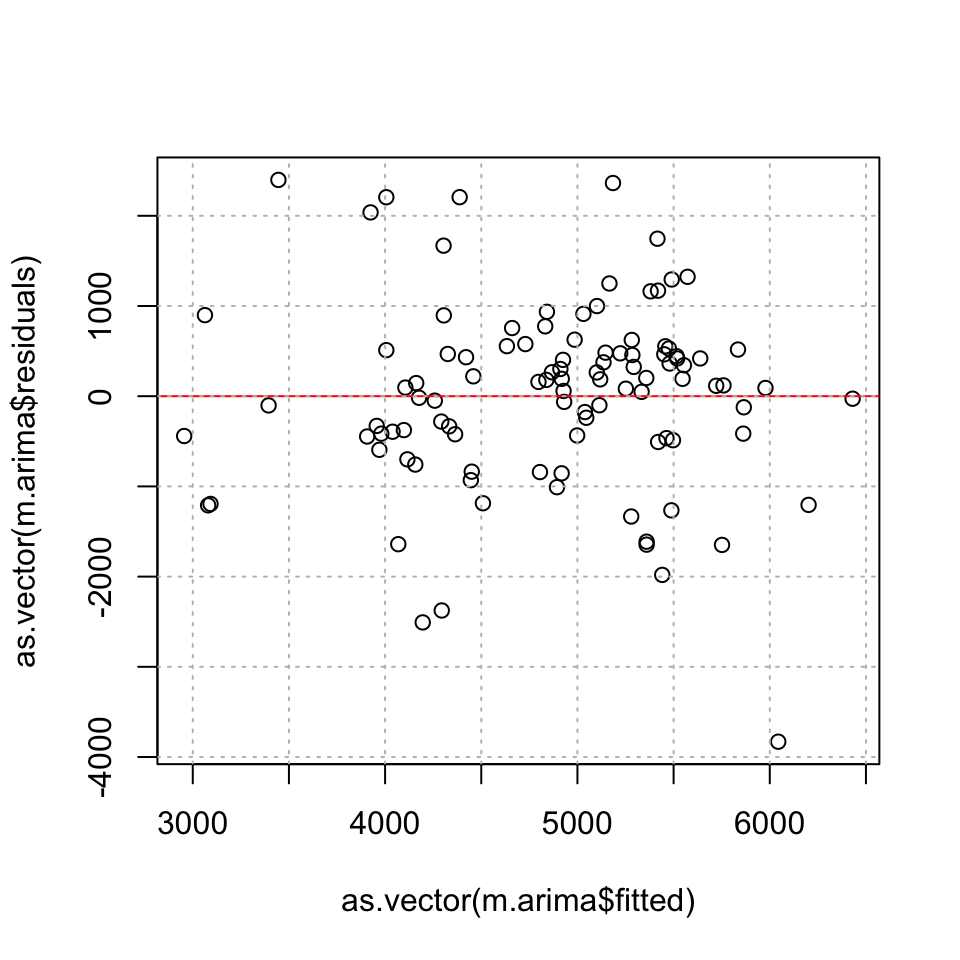

plot(y = as.vector(m.arima$residuals),as.vector(m.arima$fitted))

abline(h=0,col="red")

grid(col="grey")

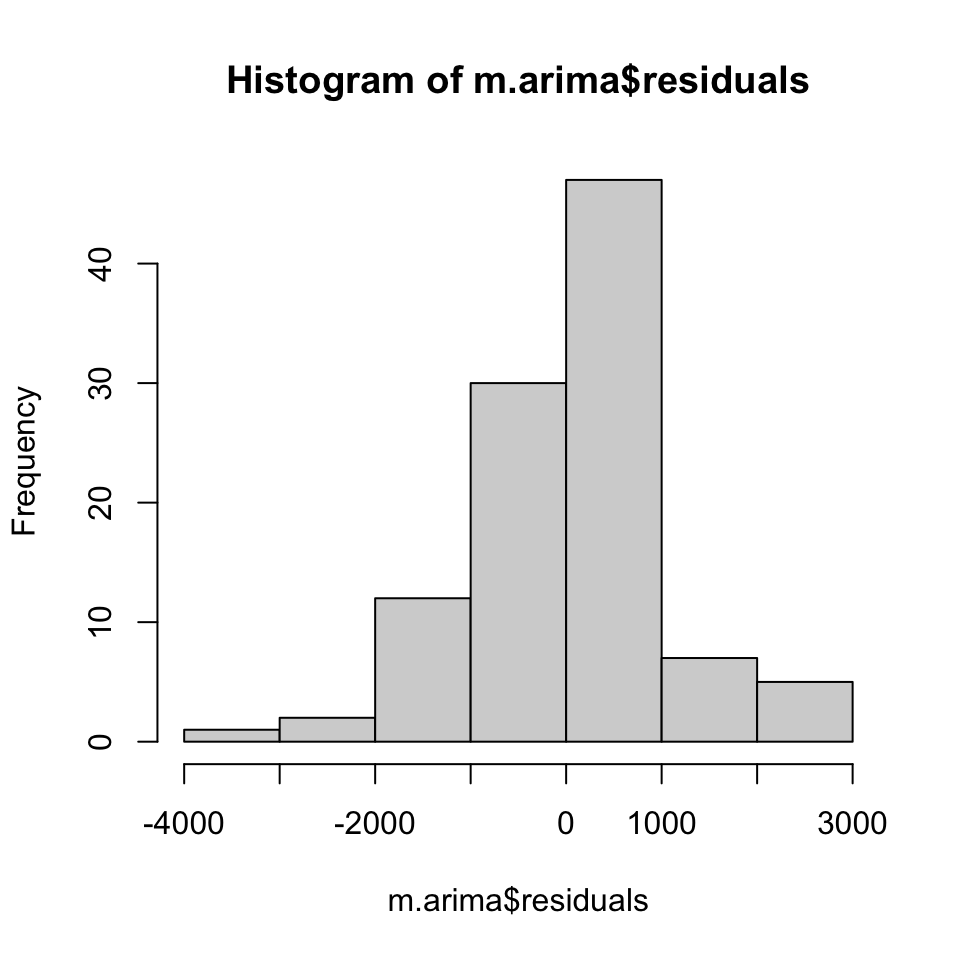

hist(m.arima$residuals)

Even though they do appear somewhat normal

Box.test(x = m.arima$residuals,type = "Ljung-Box")##

## Box-Ljung test

##

## data: m.arima$residuals

## X-squared = 0.052844, df = 1, p-value = 0.8182- Check for heteroskedasticity

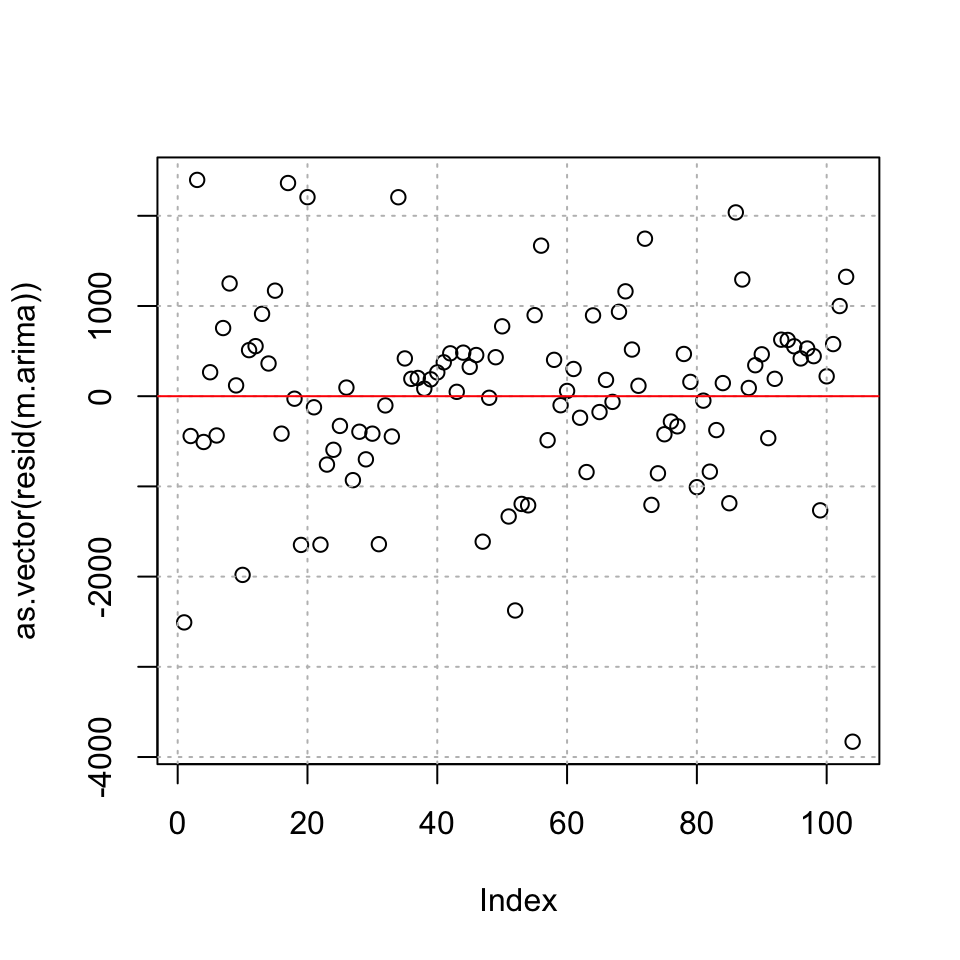

plot(as.vector(resid(m.arima)))

grid(col="grey")

abline(h=0,col="red")

It appears as if we have homoskedasticity

- Checking for independent residuals

adf.test(resid(m.arima))##

## Augmented Dickey-Fuller Test

##

## data: resid(m.arima)

## Dickey-Fuller = -4.0766, Lag order = 4, p-value = 0.01

## alternative hypothesis: stationaryThe data appears to be stationary

One could also test the other variables

3. How do these forecasts compare with actual sales?

y.test <- df$`Sales (all data)`

y.test <- y.test[105:148]

h = length(y.test)

fcast.arima <- forecast(object = m.arima,h = h)

accuracy(object = fcast.arima,x = y.test)## ME RMSE MAE MPE MAPE MASE

## Training set 23.78403 1020.006 750.8478 -5.885515 18.94088 0.9759884

## Test set 719.86985 1803.770 1424.5523 4.638826 25.18692 1.8517023

## ACF1

## Training set 0.02222022

## Test set NAWe see an accuracy of 1800 measured with RMSE.

rm(list = ls())

7.5.5 HW: Case 4 page 417-419

Not done

7.5.6 Sales data seasonal

Not done

#df <- read_excel("Data/Week47/Salesdataseasonal.xlsx")

#Arima(y = y,model = #<insert fitted arima model here, to preserve coefficients>#)7.5.7 In class assignment

It is done somewhere. Otherwise, do it again